CARDHOLDER AGREEMENT

In this Cardholder Agreement for the Paddy Power CashCard+ you will find:

Part A - General Information

and

Part B - Terms and Conditions including Fees and Charges

Part A General Information

1. Introduction

2. General Product Description

3. Parties Involved in Provision of the Card

4. Overview of Card Features

5. Other Important Information

6. Customer Services and Complaints

Part B Terms and Conditions

7. Terms and Conditions

7.1. Definitions

7.2. Keeping Your Card Safe

7.3. The Card

7.4. Using the Card

7.5. Loading of Value

7.6. Fees and Charges

7.7. Limitations of Use of the Card

7.8. Foreign Transactions

7.9. PIN

7.10. Security of Cards and YOUR CARD ACCOUNT

7.11. Contactless Transactions

7.12. Loss, Theft and Misuse of Cards

7.13. Liability

7.14. Transactions and Card Statements

7.15. Mistaken Transactions

7.16. Card Expiry

7.17. Replacement Cards

7.18. Termination, Card Revocation and Cancellation

7.19. Funds Redemption

7.20. Personal Data

7.21. Langauge and Communications

7.22. Changes to these Terms and Conditions

7.23. General

- You can load funds onto your Card multiple times by transferring returns from Bets to your Card from your Paddy Power Account using the options available on the Website or App in accordance with these Terms;

- Use of your Card is subject to certain transaction limits, as set out in section 7.7 below;

- The Card is a reloadable Mastercard Prepaid Card which means that it can be used to pay for goods and services from Merchants around the world who accept Mastercard Prepaid Cards including online transactions;

- The Card can be used to withdraw cash at participating ATMs that accept Mastercard Prepaid Cards around the world, where a Mastercard symbol is displayed;

- You can use your Card for Mastercard Contactless Transactions;

- You can access only the value that you have loaded to the Card and you will not pay or receive interest on the balance;

- We reserve the right to refuse to accept any particular transaction.

5. OTHER IMPORTANT INFORMATION

There are some other important things you need to be aware of about the Card:

- The Available Balance on the Card from the Paddy Power Account will usually become available for use by you immediately for in-person and card not present transactions;

- The Card will expire at the date shown on the front of the Card;

- If the electronic network enabling the use of the Card is unavailable, you may not be able to undertake transactions or get information using the Card;

- The ability to access the Available Balance on your Card is ultimately dependent on Paddy Power transferring the winnings from your Paddy Power Account to EML Money DAC.

6. CUSTOMER SERVICES AND COMPLAINTS

If you have a query about the Card or wish to report the card lost or stolen then you should initially direct the query to Customer Services which can be reached at Help or at Contact in the App or on the Website ('Customer Services').

Paddy Power may record any conversation you have with Customer Services for training, monitoring and/or legal and regulatory purposes.

If you are not satisfied with the service you are receiving you should provide written details of your concerns to EML at cardsupport@emlpayments.com. All queries will be handled in accordance with our complaints procedure. Customer Services will provide you with a copy of the complaints procedure upon request.

Ireland resident Cardholders may contact the Financial Services and Pension Ombudsman at Lincoln House, Lincoln Place, Dublin 2, D02 VH29 or by the following methods:

Phone: +353 1567 7000

Email: info@fspo.ie

Internet: https://www.fspo.ie

England resident Cardholders may contact the Financial Ombudsman Service at South Key Plaza, 183 Marsh Wall, London, E14 9SR or by the following methods:

Phone: 0300 123 9123 (free from most mobiles) or 0800 023 4567 (free from landlines).

Email: complaint.info@financial-ombudsman.org.uk

Internet: www.financial-ombudsman.org.uk

PART B TERMS AND CONDITIONS

7. TERMS AND CONDITIONS

7.1. DEFINITIONS

App means the Paddy Power sports betting app.

ATM means Automated Teller Machine that accepts cards with the Mastercard brand for cash withdrawals.

Available Balance means the monetary value of funds which have been transferred to your Card and are recorded as available for transactions, less any purchases, authorisations, cash withdrawals, fees and charges or other amounts debited or to be debited under these Terms.

Bets means bets placed on events via the Website

Card means the Paddy Power Mastercard Prepaid Card issued to you whether in the form of a plastic or virtual card, under these Terms.

Card Account means the electronic money account held by you with EML Money DAC and to which your Card is linked.

Cardholder Portal means EML Connect. Note: EML Connect may be given a different name as agreed between Paddy Power and EML

Card Statement means a statement of Transactions completed with your Card.

Contactless Transaction means a Mastercard Contactless transaction made by holding your Card (if Contactless Transaction functionality is available) in front of a Contactless Terminal, to complete a transaction, rather than inserting the Card into the terminal.

Contactless Terminal means a terminal which can be used to make a Contactless Transaction.

EML means EML Payments (EU) Limited.

Funds Redemption Request means a request to pay any Available Funds in accordance with section [7.19] headed Funds Redemption

Identifier means information that you know but are not required to keep secret and which you must provide to perform a transaction (for example, a Card number).

Issuer means EML Money DAC.

Mastercard means Mastercard International incorporated in New York or its successors or assigns.

Merchant means a retailer or any other person or firm or company providing goods and/or services that accepts cards displaying the Mastercard acceptance symbol in payment for such goods and/or services.

Negative Balance means a negative rather than a positive Available Balance.

Paddy Power Account means your unique account with Paddy Power the funds in which are used to place a Bet or play a game as part of the online offered by Paddy Power.

Pass Code means a password or code that you must keep secret, that we may be required to authenticate your identity or a transaction with. Examples include your PIN and any access code required to allow online access to your Card details.

Personal Data has the meaning given to it in the European General Data Protection Regulation (GDPR) (as amended or replaced from time to time);

PIN means the four digit personal identification number which we issue to you to access some of the Card services, including withdrawing cash from an ATM.

POS Purchase means a Point of Sale transaction either in person or online.

Security Requirements means the Security Requirements described under section 7.9 and ''Security of Cards And Your Card Account'' below.

Termination Date means the date of expiry of your Card (or any replacement Card issued in place of the original Card).

Terms means this Cardholder Agreement comprising Part A and Part B and any supplementary terms and/or amendments to them that we may notify to you from time to time.

Third Party Provider means a service provider (if any) authorised by law or allowed by you to access information or make payments for you in your Card Account

Transaction means any cash withdrawal, purchase of goods and/or services completed by you using your Card, or any action which alters the balance of your Card Account.

'we', 'us', 'our' means EML Money DAC and, where applicable, EML Payments (EU) Limited acting on behalf of EML Money DAC

Website means the App, or paddypower.com or any additional or replacement website, or app, we notify you as the website for the purposes of these Terms from time to time.

'you', 'your' means a person who has been (or is to be) issued with a Card and who enters into these Terms with us.

7.2. KEEPING YOUR CARD SAFE

You must keep your Card safe. Your Card is personal to you and you must not give it to anyone else to use. You must take all reasonable precautions to prevent fraudulent use of your Card.

Important points to remember to safeguard your Card:

- You must sign and activate your Card as soon as possible in accordance with section 7.3 below, you cannot use it until this is completed;

- Memorise your PIN and never store it with, near or on your Card;

- Never lend your Card to anyone;

- Never communicate your PIN or Pass Code;

- Try to prevent anyone else seeing you enter your PIN into an ATM or onto a card payment acceptance device;

- Never leave your Card unattended, e.g. in your car or at work;

- Immediately report the loss, theft or unauthorised use of your Card, PIN, Identifiers or Pass Code to Customer Services. For more information on lost and stolen cards please see section 7.11 below;

- Examine your Card Statement online to identify and report, as soon as possible, any instances of unauthorised use; and

- For security reasons, on the expiry date destroy your Card by cutting it diagonally in half and cutting through the chip and mag stripe.

7.3. THE CARD

- You must be 18 or over, a Paddy Power registered member and a resident of the UK or Ireland to apply for the Card. We may ask for evidence of your identity and of your address before we provide you with a Card. We may use third parties to obtain this information and carry out checks on our behalf. This may include using credit reference agencies. However, a credit check is not performed and your credit rating will not be affected;

- You must register as the cardholder of your Card via the Website by following the prompts in order to activate your Card. You will be unable to use or load the Card until it is activated;

- The Card is a prepaid card and funds must be loaded to the Card in accordance with these Terms to create an Available Balance before the Card can be used;

- The Card allows cash withdrawals at ATMs and purchases to be made wherever Mastercard prepaid cards are accepted if a sufficient Available Balance exists for the amount of the Transaction;

- There is no interest payable to you on the Available Balance on the Card; and

- The Card remains the property of EML Money DAC and you must surrender the Card to us if we and/or Paddy Power ask for it to be surrendered. We reserve the right to refuse to issue you a Card.

7.4. USING THE CARD

- The Card allows you to purchase goods and services anywhere Mastercard Prepaid Cards are accepted. You can also withdraw cash at an ATM displaying the Mastercard logo, subject to there being sufficient Available Balance and the Merchant or ATM being able to verify this online and subject to the spending and withdrawal limits in section 7.7 below;

- Merchants may not be able to authorise a Transaction if they cannot obtain online authorisation from us;

- You must give consent to the execution of a Transaction for it to be authorised. A Card Transaction will be regarded as authorised by you where you authorise the Transaction by following the instructions of the Merchant or ATM to authorise the Transaction which may include:

- Entering your PIN or providing any other security code, where applicable;

- Signing a sales voucher or receipt where Chip & Pin is not available;

- Providing the Card details and/or providing any other details as requested; or

- Waving, inserting or swiping the Card over a card reader and providing the PIN or other security code (if requested);

- Inserting your Card and entering your PIN to request a cash withdrawal at an ATM; and

- Any other security procedures that we require. - Authorisation for a Transaction may not be withdrawn (or revoked by you) after the time we have received it which is immediately once you have provided the authorisation. However, authorisation for any transaction which is agreed to take place on a date later than the date it was authorised may be withdrawn if you give notice to the Merchant (and provide a copy of the notice to us) as long as notice is provided no later than the close of business on the business day before the transaction was due to take place. We reserve the right to introduce a fee for transactions that are revoked in the circumstances described in the preceding sentence. This fee would only apply to transactions that are revoked following the introduction of such fee;

- If we are late in executing a payment that You instruct Us to make You may ask Us to contact the recipient's bank and ask them to credit it as if it had been received on the correct day. You agree not to make or attempt to make transactions that exceed the Available Balance. You are responsible for ensuring that you have sufficient funds when you authorise a Transaction;

- If you make or attempt to make any transactions that exceed the Available Balance then you will be liable for any Negative Balance along with any costs or interest incurred by us or anyone acting on our behalf in recovering or attempting to recover from you the amount owing. We may suspend your Card and Card Account until the Negative Balance is corrected by you. We reserve the right to deduct an amount equivalent to the Negative Balance from any funds which you subsequently pay into your Card Account;

- If a Negative Balance arises, that does not mean that a Negative Balance will be allowed to arise or be increased on subsequent occasions. This is the case regardless of whether you have been charged a fee relating to the Negative Balance occurring;

- You may get instant access to your Available Balance at ATMs worldwide (where the Mastercard logo is displayed) by using your Card and PIN or by logging into the Website or App, or by calling Customer Services;

- You can use the Card within the limits specified in section 7.7 below provided that you do not exceed the Available Balance and the expiry date for the Card has not passed;

- EML Money DAC, Paddy Power and EML accept no responsibility for the goods or services purchased by you with your Card, all such disputes must be addressed directly with the Merchant providing the relevant goods or services. If you receive a refund of sums paid for goods and services on your Card, the refund amount will be added to the Available Balance. You are not entitled to receive refunds in cash;

- EML Money DAC, Paddy Power and EML have no liability in any way when an authorisation is declined for any particular Transaction regardless of reason;

- The Card may be used at ATMs that accept Mastercard prepaid cards. ATM transaction fees and charges may apply (see Fees section 7.6 below). These are in addition to any ATM operator fees that vary by ATM operator. All ATM fees and charges will be automatically debited against the Available Balance. After the Available Balance has been exhausted or if there are insufficient funds for the payment of ATM fees and charges for a Transaction in addition to the amount of a withdrawal, the ATM transaction will be declined;

- If you permit someone else to use the Card, you will be responsible for any transactions initiated by that person with the Card;

- When using the Card with some Merchants (e.g. rental cars & hotels) or for mail order purchases, Card ''tolerance limits'' may apply. This means the Merchant may estimate the sum of money you may spend or for which you require authorisation. The estimate may be for greater than the total bill (or anticipated bill), for example

- At restaurants you may be required to have more on your Card than the value of the bill to allow for any service charge added by the restaurant;

The merchant will be required to tell you the estimated amount that will be blocked in Your Card Account and seek Your consent.

This means that some of the Available Balance on your Card may be held for up to 30 days until the Merchant has settled the actual Transaction amount and therefore you will not be able to spend this estimated sum during this period. We cannot release this sum without authorisation from the Merchant. - You may not make pre-authorised regular payments through the use of the Card;

- There are spending and other limitations on the use of your Card, please see section 7.7 below;

- Third Party Providers

a. You can instruct a Third Party Provider to access information on your Card Account or make payments from your Card Account as long as it is open and transparent about its identity and acts in accordance with the relevant regulatory requirements (but unless we say otherwise, you must not give your security details to a third party). We will treat any instruction from a Third Party Provider as if it were from you.

b. We may refuse to allow a Third Party Provider to access your Card Account if we are concerned about unauthorised or fraudulent access by that Third Party Provider. Before we do this we will tell you and explain our reasons for doing so, unless it is not reasonably practicable, in which case we will use our reasonable endeavours to tell you as soon as possible afterwards. In either case, we will tell you in the way in which we consider most appropriate in the circumstances. We won't tell you our reasons where doing so will undermine our reasonable security measures or otherwise be unlawful. We may make available to a Third Party Provider a specific means of accessing your Card Account. If we do, and it tries to access your Card Account by a different way, we may refuse to allow that access.

c. If you think a payment may have been made incorrectly or is unauthorised, you must tell us as soon as possible even where you use a Third Party Provider.

7.5. LOADING OF VALUE

Funds may only be loaded to your Card only as specifically provided in these Terms and subject to the limits shown in section 7.7 below.

When you make a request to transfer your returns on Bets to your Card on the Website or App your funds will be made available on your Card immediately after they have been received by us from Paddy Power.

If you cease to be a Paddy Power member then you will be unable to load any further funds to your Card but will be able to continue to use the Available Balance for transactions or make a Funds Redemption Request.

7.6. FEES AND CHARGES

You agree to pay the fees provided in these Terms. Whenever any of these fees are incurred or become payable, you authorise us to deduct it from the Available Balance immediately and reduce the Available Balance accordingly.

The relevant fees/limits will be based on the currency of your card.

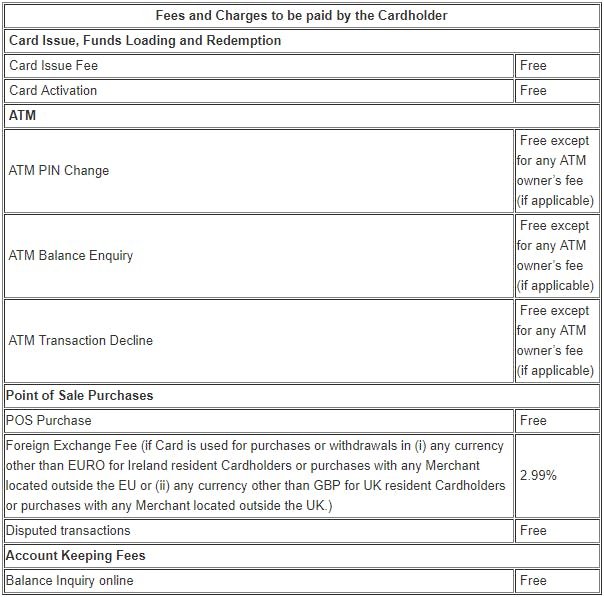

Applicable fees are as follows:

All Transaction fees are charged at the time of Transaction and are included in the total purchase price. All fees and charges are expressed and charged in Euro or GBP, as applicable, and are inclusive of any applicable VAT.

Certain Merchants may charge an additional fee if the Card is used to purchase goods and/or services and some ATMs may charge additional fees or surcharges. These fees are determined and charged by the Merchants and ATM operators and are not retained by us. You may also be subject to a Merchant's terms and conditions of business. It is your responsibility to check before proceeding with your Transaction.

7.7. LIMITATIONS OF USE OF THE CARD

EML Money DAC, Paddy Power and EML are referred to collectively as ''we'', ''us'' and ''our'' in this section 7.7 and can each act jointly and severally in relation to this section. The following limitations apply to the Card:

- The Card may not be used for, and authorisation may be declined for, any illegal transactions;

- Some retailers may choose not to accept Mastercard prepaid cards;

- We reserve the right to decline any Transactions at our discretion and we may at any time suspend, restrict or cancel your Card or refuse to issue or replace a Card for reasons relating to the following:

- We are concerned about the security of your Card or Card Account;

- We suspect your Card is being used in an unauthorised or fraudulent or suspicious manner;

- Paddy Power suspects that your Paddy Power Account is being used in an unauthorised or fraudulent or suspicious manner;

- You break an important part of these Terms or repeatedly break any term of these Terms and fail to resolve the matter in a timely manner;

- If the Available Balance is insufficient to cover the relevant Transaction and any applicable fees;

- We need to in order to comply with applicable law, regulation or MasterCard rules; or

- If any information you have provided is found incorrect or incomplete.

If we do stop or restrict your use of the Card then we will tell you as soon as we are permitted to do so either before or after we have taken such steps or as soon as practically possible, unless it would be unlawful for us to do so. - We will not be liable in the event that a Merchant refuses to accept your Card, or if we do not authorise a Transaction, or if we cancel or suspend the use of your Card as permitted in these Terms. Unless otherwise required by law, we shall not be liable for any loss or damage you may suffer as a result of your inability to use your card for a Transaction.

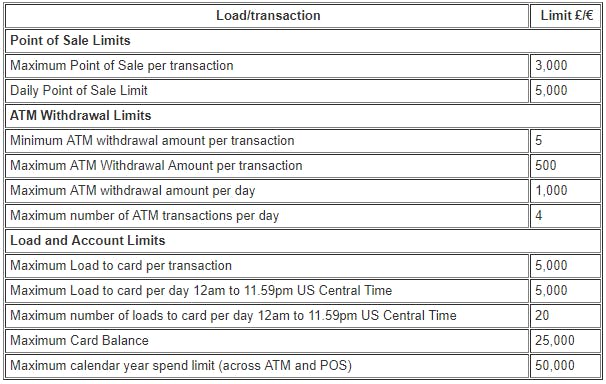

The following table illustrates the transaction and load limits applicable to the Card

The relevant fees/limits will be based on the currency of your card.

7.8. FOREIGN TRANSACTIONS

If the Available Balance on your Card is in Euro, Transactions made in a currency other than Euro will be subject to the prevailing Mastercard exchange rate applicable at the time plus a 2.99% foreign exchange fee. We will use Mastercard authorised rates applicable for such a transaction, see www.mastercard.com/global/currencyconversion. The Mastercard exchange rate is set by Mastercard and any changes made by Mastercard will be effective immediately. Example of Foreign Exchange Fee:

- You make a purchase from a Merchant located in the UK;

- At the time, Mastercard's prevailing exchange rate is £1.00 = 1.091EUR;

- You spend £200.00 ;

- The Euro amount is £200.00 x 1.091EUR = 218.2EUR;

- The foreign exchange fee is therefore 2.99% x 218.2EUR = 6.52EUR.

If the Available Balance on your Card is in GBP, Transactions made in a currency other than GBP will be subject to the prevailing Mastercard exchange rate applicable at the time plus a 2.99% foreign exchange fee. We will use Mastercard authorised rates applicable for such a transaction, see www.mastercard.com/global/currencyconversion. The Mastercard exchange rate is set by Mastercard and any changes made by Mastercard will be effective immediately. Example of Foreign Exchange Fee:

- You make a purchase from a Merchant located in the EU;

- At the time, Mastercard's prevailing exchange rate is 1.00EUR = £0.909;

- You spend 200.00EUR ;

- The GBP amount is 200.00EUR x £0.909 = £181.8;

- The foreign exchange fee is therefore 2.99% x £181.8 = £5.43.

For a full listing of fees and charges please refer to section 7.6 Fees and Charges above.

7.9. PIN

- Your PIN can be viewed at any time online on the Cardholder Portal.

- Should an incorrect PIN be entered three times when a transaction is attempted (at POS or ATM) using the Card, the Card will blocked and you will need to visit an ATM with PIN change functionality and change your PIN before you can use it again.

- Should the Card be retained by any ATM, the Card is deemed to be lost or stolen and hence cannot be recovered. In that event, you will need to contact Customer Services and arrange to be issued with a new Card; and

- You must not disclose your PIN to any other person.

7.10. SECURITY OF CARDS AND YOUR CARD ACCOUNT

You must make sure that you keep the Card, Identifiers and any PINs safe and secure. The precautions we require you to take (Security Requirements) are set out below. You must not:

- Allow anyone else to use the Card;

- Interfere with any magnetic stripe or integrated circuit on the Card;

- Unnecessarily disclose the Card number;

- Write the PIN on the Card;

- Carry the PIN with the Card;

- Record the PIN on anything carried with the Card or liable to loss or theft simultaneously with a device, unless you make a reasonable attempt to protect the security of the PIN; or

- Voluntarily disclose the PIN to anyone, including a family member or friend.

You must comply with any other security procedures that we tell you about from time to time.

You must also keep your Card Account ID Information confidential and secure. This includes ensuring the ongoing security of your Card Account ID Information and your personal computer device for accessing the Internet.

If you know or suspect that your Card is lost or stolen or your PIN is known by someone else you must tell us without undue delay by contacting Customer Services and change your PIN as soon as possible. You can change it at ATMs that offer this service by selecting the PIN Services option. Any undue delay in notifying Us may not only affect the security of Your Card Account but may result in You being liable for any losses as a result where Your failure to notify Us is intentional or negligent. If You suspect that Your Card was used or Your Card Account was accessed by someone else, You should also contact the police and report the incident.

If we think your Card or Card Account is at risk of fraud or a security threat, we will use the fastest and most secure way practicable of contacting you using the details you have provided to tell you what you need to do to help deal with that risk.

7.11. CONTACTLESS TRANSACTIONS

If your Card has Contactless Transaction functionality then you may use your Card to make a Contactless Transaction for purchases up to [Euro 30], or such other limit as determined by a Merchant or applicable regulation, at Contactless Terminals without having to sign or enter a PIN. You can use your Card with Mastercard Contactless technology across various Merchants accepting Contactless Mastercard transactions. If your Card has Contactless Transaction functionality which you use frequently then you may periodically be asked to authorise a transaction via an alternative method (such as using your PIN) for security reasons.

7.12. LOSS, THEFT AND MISUSE OF CARDS

You should treat the Available Balance on your Card like cash in a wallet. If your Card is lost or stolen or used without authorisation then you may lose some or all of the Available Balance in the same way as if you lost cash. If you know or have reason to suspect that the Card is lost or stolen or damaged, likely to be misused or you have reason to suspect that someone else may know the PIN or Identifiers, you must immediately notify Customer Services.The Card will then be suspended to restrict further use.

If any lost Card is subsequently found it must not be used and you must destroy it and inform Customer Services immediately.

Subject to the paragraph below, in the event your Card is lost or stolen, and you have kept the personalised features of your card safe from misappropriation then you may be liable for the first GBP 35 (or the first Euro 50 in the case of Ireland resident Cardholders) with respect to Transactions from the use of your lost, stolen or misappropriated Card. If you have acted fraudulently or with intent or gross negligence or in breach of these Terms, you may be liable for the full amount of loss(es) incurred. No refund will be made until any investigation we need to undertake is complete. We reserve the right not to refund you if we believe you have not complied with these Terms. You may be required to help us or our agents or any law enforcement agency on request if your card is lost, stolen or we suspect it is being misused.

You will not be liable for any losses incurred in respect of an unauthorised Transaction if you have exercised reasonable care in safeguarding your Card and Pass Code and any other log-in details from risk of loss or theft and, upon becoming aware of an unauthorised Transaction or the loss or theft of your Card or PIN or other log-in details, you notified us promptly. Once you have notified us of the loss, theft, misappropriation or unauthorised use of your Card or Pass Code or other log-in details and, provided you have not acted fraudulently or with gross negligence, we will refund the amount of any Transaction that occurs which our investigations show were not authorised by you.

7.13. LIABILITY

EML Money DAC, Paddy Power and EML are referred to collectively as ''we'', ''us'' and ''our'' in this section 7.12 and each can enforce this section jointly and severally.

In the case of an unauthorised payment or a payment that was incorrectly executed due to an error by us, we shall, as soon as is practicable, and in any event no later than the end of the business day following the day on which we become aware of the unauthorised transaction, refund the payment amount including all fees deducted therefrom except in circumstances where we have reasonable grounds to suspect fraudulent behaviour on the part of the Cardholder. This shall not apply:

- where the unauthorised payment arises from your failure to keep the personalised security features of your Card or Card Account safe in accordance with section 7.11 of these Terms and Conditions, in which case you shall remain liable for the first first GBP 35 (or the first Euro 50 in the case of Ireland resident Cardholders) unless section 7.12(c) applies

- if you fail to notify us without undue delay of any loss of your PIN or Card Account ID Information or other event that could reasonably be expected to have compromised the security of your Card or Card Account after you have gained knowledge of such event in which case you shall remain liable for losses incurred until you notify us;

- if the transaction was unauthorised but you have acted fraudulently or compromised the security of your Card or Card Account with intent or gross negligence, in which case you shall be solely liable for all losses; or

- if you fail to dispute and bring the unauthorised or incorrectly executed transaction to our attention within 13 months from the date of the transaction.

In all other circumstances our liability will be limited to repayment of the amount of the funds in Your Card Account.

Unless you have acted fraudulently, section 7.12(a) shall not apply to transactions made after you have notified us in accordance with this Agreement where we have failed to provide you with appropriate means for notification or we are required to use strong customer authentication but fail to do so, in which case we shall remain liable and refund any unauthorised transaction to you as soon as practicable.

Without prejudice to the foregoing, you are asked to check the transactions history of your Card Account regularly and frequently and to contact Customer Service immediately in case you have any questions or concerns.

In the case of any incorrect or misdirected payment, we shall take reasonable measures to assist you with tracing and recovering such payments.

Subject to the foregoing, we shall not be liable for any disruption or impairment of our service or for disruptions or impairments of intermediary services on which we rely for the performance of our obligations hereunder, provided that such disruption or impairment is due to abnormal and unforeseeable circumstances beyond our reasonable control or the control of the intermediary affected.

We shall not be liable for any indirect or consequential losses including but not limited to loss of profit, loss of business and loss of reputation. We shall not be liable for any losses arising from our compliance with legal and regulatory requirements.

While we try to ensure the Website and any other operating channels are available at all times we make no warranty that these will be available and error free at all times. From time to time your ability to use the Card may be interrupted for example when maintenance is carried out. This means you may be unable to load your Card, make Transactions or obtain information about your Available Balance or recent Transactions.

All conditions, warranties or other terms implied by law are excluded to the fullest extent permitted by applicable laws and regulations, save that nothing will limit our liability to you for death or personal injury arising out of our negligence or for our fraud, or insofar as any limitation or exclusion of liability is prohibited by law.

Although EML Money DAC's activities are regulated by the Central Bank of Ireland, neither your Card or your Card Account are covered by the Financial Services Compensation Scheme. However, the funds in your Card Account are safeguarded by EML Money DAC, which means that they are kept separate from EML Money DAC's assets so in the unlikely event that EML Money DAC becomes insolvent your funds remain safe from EML Money DAC's creditors.

Our obligation under these Terms and Conditions is limited to providing you with a Card, a Card Account and related payment services and we do not make any statement in relation to or endorsement of the quality, safety or legality of any goods or services provided by any merchant or intermediary.

We shall not be liable for the assessment or payment of any taxes, duties or other charges that arise from your use of your Card or Card Account or services provided in these Terms and Conditions.

You agree to defend, reimburse or compensate us and hold us and our other companies in our corporate group harmless from any claim, demand, expenses or costs (including legal fees, fines or penalties) that we incur or suffer due to or arising out of your or your agents' breach of these Terms and Conditions, breach of any applicable law or regulation and/or use of the services. This provision shall survive termination of the relationship between you and us.

7.14. TRANSACTIONS AND CARD STATEMENTS

You understand and agree that you will not receive Card Statements on paper from us regarding the operation of your Card. You can view your Available Balance and Transactions on the Website together with the date of receipt or transmission (the credit or debit value date), the fees charged and, where applicable, any exchange rate used on the Website at any time. Each transaction is given a unique transaction ID and shown in the transaction history. You can download or print out your Card Statement at any time in real time from the Website and retain for your records. We will not alter or amend information displayed in your online transaction history. You should quote this transaction ID when communicating with us about a particular transaction. You should check your Card Account balance and transaction history regularly. You should report any irregularities or clarify any questions you have as soon as possible by contacting Customer Services. You are responsible for keeping your log in details secret and if you suspect someone else is using your details you must contact Customer Services to advise them immediately.

It is your responsibility to regularly review your transaction history to identify unauthorised Transactions.

7.15. MISTAKEN TRANSACTIONS

It is your responsibility to correctly enter all information into an ATM or other system or equipment with which you undertake a Transaction or information request using a Card or Card details including any Transaction amounts. We will not be responsible for the consequences of incorrect data entries made by you.

7.16. CARD EXPIRY

The Card is valid until the expiry date shown on its front, unless its use is terminated earlier by us or you in accordance with these Terms. You will not be able to use your Card once it has expired, nor will you be able to use the Available Balance.

We may issue you with a replacement Card if requested by you at any time after expiry and provided you have registered your details with us. We reserve the right not to issue a replacement Card to you.

If you do not request, and we have not provided you with a replacement Card following expiry of your Card, then any Available Balance will remain for a period of 6 years from the Card expiry date. You may contact Customer Services to request your Available Balance be returned to you at any time within the 6 year period as set out in the Funds Redemption section 7.19 below. A redemption fee may apply which will be notified to you at the time. Any Available Balance remaining after 6 years will not be refunded.

7.17. REPLACEMENT CARDS

If your Card or Card details are misused, lost or stolen, or your Card is damaged you should notify Customer Services immediately in accordance with section 7.12 above so that your Card can be cancelled.

You can request a replacement Card and we may comply with that request (a fee may apply, see section 7.6 fees and charges above). You will need to register and activate the new Card in accordance with section 7.3 above and you may need to provide us with your Card number and other information so that we can identify you.

7.18. TERMINATION, CARD REVOCATION AND CANCELLATION

You have a right to cancel your Card and these Terms without reason and at no cost within the 14 day period following when you receive your Card (''Cancellation Period'') or in the event you disagree with a change we intend to make to these Terms by contacting Customer Services and also confirming your wish to cancel in writing. You will not be charged a cancellation fee and will not receive a refund of any Transactions authorised or pending or any fees incurred in connection with the Card before it is cancelled.

These Terms will automatically terminate on the Termination Date, however you may ask for the Card to be cancelled or terminate these Terms at any time (which will result in the Card being cancelled) before the Termination Date by contacting Customer Services. Subject to your right to cancel set out in the first paragraph of this clause 7.17, we reserve the right to introduce a cancellation fee for any Card so terminated before the Termination Date. This fee would only apply to cards that are cancelled following the introduction of such fee. Following your cancellation request, if we ask you to, you must surrender or destroy the cancelled Card and you must not use the cancelled Card. You will be responsible for any Transactions made or charges incurred before you cancelled your Card and if any sums are incurred on your Card following cancellation or termination you will pay such amounts to us immediately on demand.

We may terminate these Terms at any time prior to the Termination Date on provision of two months' notice to you or terminate or suspend them (and the use of your Card) immediately if (i) you have not complied with these Terms; or (ii) we have reason to believe you have used or intend to use the Card negligently or for fraudulent or unlawful purposes; (iii) we need to do so in order to comply with applicable law or regulation or MasterCard rules or (iv) we are required to do so by any applicable regulatory body , or (v) if you fail to pay any fees or charges or correct a Negative Balance.

These Terms will terminate immediately in the event of your death.

If these Terms are terminated or your Card is cancelled then you must destroy it by cutting diagonally through the chip and magnetic strip.

On the cancellation of the Card or termination of these Terms, we will block your Card straight away so it cannot be used and wait until we are satisfied that all Transactions have been processed and there are no outstanding authorisations or other restrictions on the Card before we refund the Available Balance (less any applicable Fees) to you. This is to ensure all pending Transactions have been settled. We may ask for evidence of your identity or confirmation the card has been destroyed before we make such refund.

Subject to any amounts owing to EML Money DAC or EML, we will pay the Available Balance back to your bank account and we may require evidence that the bank account belongs to you before we are able to transfer the Available Balance to it.

7.19. FUNDS REDEMPTION

Whether or not you have a current Card to transact against your Available Balance, you may instruct us to pay the Available Balance by sending it to your bank account (Funds Redemption Request) by contacting Customer Services. We do not have to process a Funds Redemption Request until we are satisfied of your identity and may require you to provide us with suitable identification documents for this purpose.

Upon receiving a Funds Redemption Request, we will pay the Available Balance to you when:

- we are satisfied that there are no un-cancelled or unexpired authorisations or approvals on the Card; and

- we are satisfied that there are no further amounts that we will be debiting, or that we anticipate debiting, against the Available Balance;

- we are satisfied of your identity; and

- if we require it, we have received any surrendered or cancelled Cards from you.

We will pay the Available Balance to your bank account.

7.20. PERSONAL DATA

EML Money DAC, Paddy Power and EML are referred to collectively as ''we'', ''us'' and ''our'' in this section 7.20 and each can act jointly and severally in relation to this section. We will collect and retain Personal Data about you so that we can operate your Card Account and deal with any inquiries that you may have about it.

You explicitly consent to Us accessing, processing, and retaining any information You provide to Us, for the purposes of providing payment services to You. This does not affect our respective rights and obligations under data protection legislation. You may withdraw this consent by closing Your Card Account. If You withdraw consent in this way, We will cease using Your data for this purpose, but may continue to process Your data for other purposes where We have other lawful grounds to do so, such as where We are legally required to keep records of Transactions.

We are also required to collect Personal Data to identify you and verify your identity. Without your information we cannot make the Card available to you and you should not apply for the Card.

The processing of your Personal Data is governed by the EML Money DAC and EML privacy policies (as applicable) which can be found at https://secure.perfectpaas.com/Help/PrivacyPolicy and by Paddy Power's privacy policy (as applicable) which can be found via the Website. You have already agreed to the terms of the Paddy Power privacy policy when opening your Paddy Power Account, by accepting these Terms, you also agree to the terms of the EML Money DAC and EML privacy policies. For further information please contact Customer Services.

7.21. LANGUAGE AND COMMUNICATIONS

These Terms were drafted in the English language and all correspondence with you in respect of your Card and Card Account shall be in English. If there is a conflict between any translation of these Terms and the English language version then the English language version shall prevail.

You must let us know as soon as possible if you change your name, address, telephone number or e-mail address. If we contact you in relation to your Card, for example, to notify you that we will be changing the Terms or have cancelled your Card and wish to send you a refund, we will use the most recent contact details you have provided to us. Any e-mail to you will be treated as being received as soon as it is sent by us. We will not be liable to you if your contact details have changed and you have not told us.

7.22. CHANGES TO THESE TERMS AND CONDITIONS

We may change these Terms including without limitation changing existing fees or introducing new fees, from time to time. We will provide you with at least two months' notice before the proposed change comes into effect, however changes that (i) make these Terms more favourable to you or that have no adverse effect on your rights or (ii) relate to exchange rates shall come into effect immediately if so stated in the change notice. All such changes will be posted on the Website and by any other means that we agree with you. Changes to exchange rates can be made immediately and without notice.

The most up-to-date version of these Terms is always available on the Website and you should check the Website regularly so you can see the latest version. You are bound by these Terms and any amendments made to them so we recommend that you print a copy to keep for your records.

You will be taken to have accepted any change we notify to you unless you tell us that you do not agree to it prior to the change taking effect. In such circumstances, we will treat your notice to us as notification that you wish to terminate these Terms immediately and we will refund any Available Balance to your bank account in accordance with section 7.18 above. In this circumstance you will not be charged a refund fee.

7.23. GENERAL

Any failure or delay by us to enforce a term of these Terms does not mean we have waived that term on that occasion or any subsequent occasion.

In the event any part of these Terms are held not to be enforceable then this shall not affect the remainder of these Terms which shall remain in full force and effect.

Headings used in these Terms are for convenience only and shall not affect the interpretation of these Terms.

You will remain responsible for complying with these Terms until your Card and Card Account are closed (for whatever reason) and all sums due under these Terms have been paid in full.

You may not novate, assign, transfer, subcontract or delegate any rights and/or benefits or burdens under these Terms. We may novate, assign or transfer any rights and/or benefits or burdens of these Terms to another entity at any time without prior notice to you and without your further consent. If you do not wish to transfer to the new Card issuer then you may contact Customer Services and we will terminate your Card and any Available Balance will be returned in accordance with the Funds Redemption section 7.19 above. We may subcontract any of our obligations under the Terms.

To the fullest extent permitted by law and without affecting your legal rights as a consumer under applicable law, these Terms and any dispute or claim arising out of or in connection with them or their subject matter or formation (including non-contractual disputes or claims) shall be governed by, and construed in accordance with, the laws of the Republic of Ireland. The courts of the Republic of Ireland shall have jurisdiction in relation to such disputes and claims referred to in the previous sentence.

If you are a UK resident Cardholder, as a consumer, you will benefit from any mandatory provisions of the law of the country in which you are resident. Nothing in these Terms, including reference to the choice of law clause or jurisdiction clause, affects your rights as a consumer to rely on such mandatory provisions of local law.

Mastercard is a registered trademark, and the two circles design is a trademark of Mastercard International Incorporated.